How Headaches Are Piling Up for China’s Mighty Tech Firms

What You Need To Know

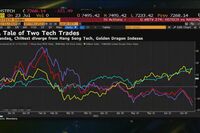

China’s government has again stunned investors and tech industry players in past weeks, ordering Didi Global Inc. to delist post-haste from New York in a move unprecedented for a company of its size. That caps a singular year in which Beijing unleashed a plethora of regulations that — among other things — threatened to obliterate much of the country's $100 billion online education sector, cripple the gaming industry and upend business models across the internet industry.

The State Council or cabinet, which stamped its authority on Didi's clampdown early on, had warned it will crack down on overseas listings in the interest of safeguarding national security. It plans to move swiftly to close a big loophole that China’s largest corporations have used since 2000 to float abroad — making its strongest move yet to take control of a trend that’s enriched tech giants and bankers alike for two decades.

Key Coverage

By The Numbers

- $1.5 trillion Estimated market value lost by listed Chinese tech giants since a February 2021 peak

- 493 million The size of Didi's user base, mostly in China, according to its prospectus filed June 29, 2021

- $1.8 trillion Combined market cap of 270 Chinese companies with depositary receipts that allow them to trade in the U.S., according to a Bank of America report in Nov. 2021

Why It Matters

Unfolding in rapid-fire fashion over the July 4 weekend and subsequent months, the moves against Didi and other Chinese tech giants marked an expansion and escalation in a broader campaign to curb the growing power of internet titans from Jack Ma’s Ant and Alibaba to Tencent and Meituan since late 2020. It also sent a chilling warning to investors, that Beijing is willing to target excesses in its domestic sectors at the expense of foreign investors.

It’s the culmination of a growing perception in Beijing in recent years that — following years of phenomenal, near-unchecked expansion — online businesses are amassing valuable data, minting billionaires and creating private business strongholds with enough resources and popular followings to perhaps someday threaten the Communist Party’s grip on power.

The government is now employing various avenues — including anti-monopoly investigations, new laws and direct communications with top executives — to rein them in. With Didi, that campaign has pivoted to take direct aim at the source of their power: The enormous amounts of data that they hoover up daily from hundreds of millions (in some cases, upwards of a billion) users both at home and abroad.

President Xi Jinping’s government wants to find a way to harness that data to fuel more broad-based economic growth over the next few decades. The moves have chilled the global investment community and ratcheted up the uncertainty.

Beijing’s regulatory crackdown on fintech to education to ride-hailing will alter the corporate landscape and affect foreign investment.

Timeline

-

5 months ago Didi Extends Drop as China Weighs Rule Changes

-

5 months ago China’s Overseas IPOs

-

5 months ago How Wall Street Lost Sight of Didi's Risks

-

6 months ago How Jack Ma Crossed China's Red Lines